**Full Disclosure: This is a sponsored conversation written by me on behalf of DriveTime. The opinions and text are all mine.

Tax season is very quickly approaching. It’s not my favorite and I try hard to avoid it. As a self-employed person, adding up what I’ve made, compiling all my expenses and making sure I have all the forms I need is not my idea of fun. But once our taxes are filed and I know how much of a refund I’ll be getting, I can relax! My husband and I start thinking about what we can spend that refund on before we even start taxes. We usually spend our refund on necessary household items or put it in our savings account.

Most Americans use their tax returns in sensible ways. They pay down debt, save it or spend it on necessities. Only a small percent of tax return recipients splurge and use their money to take a vacation.

Sensible Ways to Use Your Tax Return:

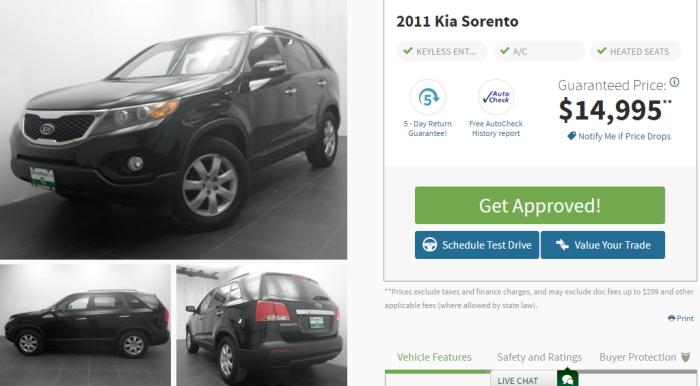

- Down Payment on a New-to-Your Car – A down payment on a new car?! COOL, am I right? And, yep, with DriveTime, you can use your tax refund to put a down payment on a new-to-you vehicle. Find a DriveTime dealership here. I don’t currently need a new car but if I did, I’d love this 2011 Kia Sorento from DriveTime!

- Pay Down Debt – Get caught up on old bills or pay off high-interest debt. It’s a quick and easy way to get rid of a little debt.

- Save It – Put it in an account for emergencies or college savings, contribute to a Roth-IRA or purchase savings bonds. Having savings is always a great idea and tax returns make it easy to add a decent chunk of money – especially if you get the child credit!

Whatever you decide to spend your tax return on, do your research. Make a smart choice for your money. If you decide to put a down payment on a new-to-you car, you should read 3 Reasons Buying a Used Car with a Tax Return is a Smart Choice.

Leave a Reply